Title loan risk assessment critically examines collateral value, borrower creditworthiness, loan type, and lender verification methods. This impacts approval, rates, and terms. Comparisons between lenders' approaches are key for borrowers seeking fast cash solutions. Accurate assessments minimize losses, promote fair lending via thorough borrower financial reviews, transparent communication, clear terms, flexible repayment options, and early payoff possibilities.

In the dynamic landscape of short-term lending, understanding title loan risk assessment is paramount. This article explores the variations among lenders, delving into critical factors that influence risk evaluations. We conduct a comparative analysis of lender practices, highlighting best processes for accurate appraisals. By examining key considerations such as collateral valuation and borrower creditworthiness, this guide equips readers with insights to navigate the complexities of title loan risk assessment effectively.

- Understanding Title Loan Risk Assessment Factors

- Comparative Analysis of Lender Evaluations

- Best Practices for Accurate Risk Appraisals

Understanding Title Loan Risk Assessment Factors

Understanding Title Loan Risk Assessment Factors

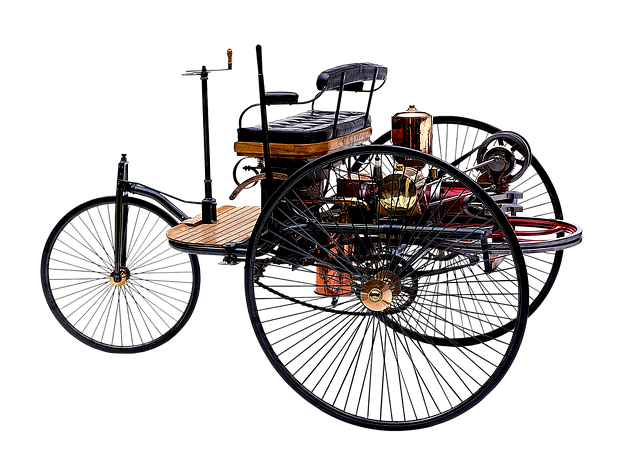

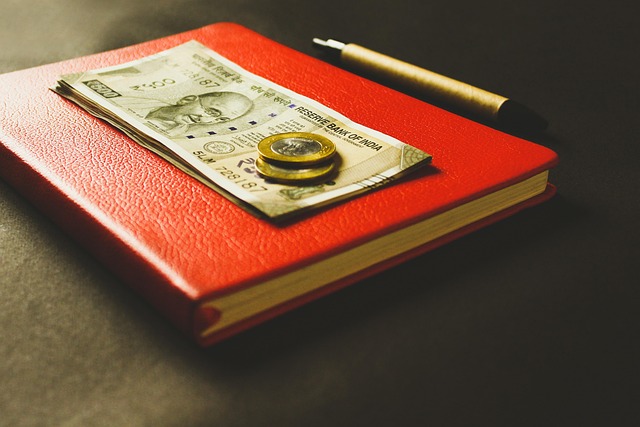

When it comes to title loan risk assessment, several key factors come into play. These include the value and condition of the underlying asset, such as a vehicle or real estate, which serves as collateral for the loan. Lenders also consider the borrower’s financial history, including their credit score and income stability, to gauge their ability to repay the loan. The type of title loan sought—whether it’s a car title loan or even semi truck loans—can significantly impact risk assessment due to varying repayment terms and security types.

Additionally, lenders may employ various credit check methods to assess borrowers’ financial health. These checks help in identifying potential risks associated with non-repayment, default, or fraudulent activities. In the context of fast cash needs, understanding these risk assessment factors is crucial for borrowers as it influences loan approval, interest rates, and overall terms of the title loan agreement.

Comparative Analysis of Lender Evaluations

When comparing different lenders in the title loan industry, a key metric to scrutinize is their risk assessment methods. Each lender employs its own unique approach to evaluate borrowers’ creditworthiness, often driven by the specific types of loans they offer – like fast cash personal loans or specialized semi truck loans. Some focus extensively on traditional credit scores, while others delve deeper into asset valuation and repayment history, especially for collateral-based loans such as car title loans.

A comprehensive comparative analysis reveals stark variations in risk assessment strategies. Lenders catering to fast cash short-term loans might prioritize speed and flexibility, potentially minimizing thoroughness in their credit checks. Conversely, specialized lenders for semi truck loans or other asset-backed financing may conduct more intricate analyses, ensuring the value and security of the underlying collateral. This underscores the importance of understanding a lender’s risk assessment approach to make informed decisions when seeking title loan services.

Best Practices for Accurate Risk Appraisals

Accurate risk assessments are paramount for title loan lenders to mitigate potential losses and ensure fair lending practices. To achieve this, lenders should embrace best practices that encompass a comprehensive review of borrower financial health, including their credit history, debt-to-income ratio, and ability to repay the loan. Incorporating alternative data points, such as employment verification and bank statements, can provide a more holistic view of a borrower’s financial stability and capability to manage repayments, thereby enhancing the Title loan risk assessment process.

Furthermore, focusing on transparent communication with borrowers throughout the loan approval process cultivates trust and encourages responsible borrowing behavior. Providing clear terms and conditions, outlining expected repayment timelines, and offering options for early payoff or access to emergency funds when needed, empowers borrowers to make informed decisions while enabling lenders to maintain robust risk management strategies.

Title loan risk assessment varies among lenders, with each adopting unique methodologies based on internal policies and market insights. Understanding these variations is crucial for borrowers seeking fair evaluations. By comparing lender assessments and adhering to best practices, individuals can navigate the process more effectively. This ensures that risk appraisals are accurate, promoting a healthier lending environment.