Title loan risk assessment is a vital process where lenders evaluate borrower eligibility using income, employment history, debt-to-income ratio, and credit score. Stable incomes and good credit scores lead to more favorable loan terms, while poor credit or high debt result in stricter conditions. Lenders scrutinize disposable income to ensure borrowers can meet needs and repay loans on time. Individuals with higher incomes should focus on flexible loan terms and emergency funds, whereas lower-income borrowers should create budgets and explore alternatives like credit unions.

Title loans, a quick fix for financial needs, come with inherent risks. Understanding how income influences these risk assessments is crucial for borrowers. This article delves into the intricate relationship between your earnings and title loan eligibility.

We explore key factors that determine risk, focusing on how income impacts collateral value and repayment capabilities. Furthermore, we provide strategies to mitigate risks for borrowers across all income brackets, ensuring informed decision-making in this financial sector.

- Understanding Title Loan Risk Assessment: Key Factors at Play

- The Impact of Income on Collateral Value and Repayment Ability

- Mitigating Risks: Strategies for Borrowers with Varying Income Levels

Understanding Title Loan Risk Assessment: Key Factors at Play

Understanding Title Loan Risk Assessment: Key Factors at Play

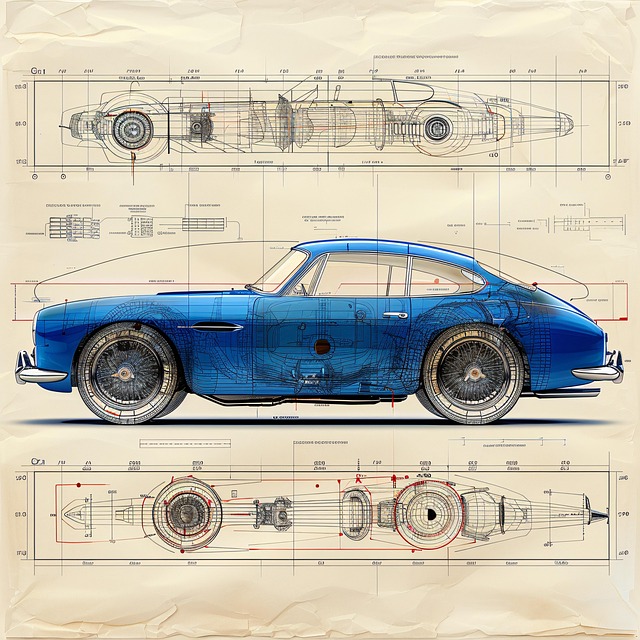

When it comes to title loans, risk assessment is a critical component that lenders use to determine eligibility and interest rates. A title loan risk assessment evaluates several factors to gauge the borrower’s ability to repay the loan, ensuring both fairness in lending practices and minimizing financial risks for lenders. The primary focus is on the value and condition of the asset being used as collateral—typically a vehicle, with semi truck loans being a specialized case.

Key elements influencing this assessment include the borrower’s income, employment history, debt-to-income ratio, and the overall credit score. For instance, individuals with stable and substantial incomes often face lower risk profiles, facilitating quicker funding options. On the other hand, those with poor credit or high debt obligations may find it challenging to secure favorable terms, including debt consolidation options. These factors collectively contribute to shaping the terms of the loan, ensuring a balance between accessibility for borrowers in need of quick funding and responsible lending practices.

The Impact of Income on Collateral Value and Repayment Ability

A key factor in assessing the risk associated with a title loan is understanding the borrower’s financial health, which is closely tied to their income levels. Income plays a pivotal role in determining both the value of the collateral and the borrower’s capacity to repay the loan. When evaluating a potential title loan candidate, lenders assess how much disposable income they have after covering basic expenses. This available income directly influences their ability to make timely repayments without defaulting.

A stable and substantial income stream is beneficial for borrowers as it increases the likelihood of successful loan repayment. It allows individuals to cover living expenses while setting aside funds for loan payments, ensuring financial stability throughout the loan period. In contrast, limited or unpredictable income sources can be a red flag for lenders, indicating potential risks associated with default or delayed repayments. This is especially relevant when considering repayment options and the need for vehicle inspection as part of the title loan process.

Mitigating Risks: Strategies for Borrowers with Varying Income Levels

For borrowers seeking car title loans or title pawn, understanding one’s financial situation is a proactive step in mitigating risks associated with the title loan risk assessment. Individuals with higher incomes have a distinct advantage as they can often afford more flexible loan terms, allowing them to navigate unexpected expenses without defaulting. They may also consider building an emergency fund, which acts as a safety net and reduces the likelihood of turning to short-term lending.

On the other hand, borrowers with lower or unstable incomes should focus on creating a budget and sticking to it. This strategy ensures they meet their basic needs and obligations while keeping loan repayments manageable. Exploring alternatives like credit unions or community support programs can also help alleviate financial strain, reducing the need for high-interest title loans. By implementing these strategies, borrowers across income levels can make informed decisions, ensuring a healthier financial outlook and minimizing potential risks.

Understanding how income impacts title loan risk assessment is crucial for both lenders and borrowers. Income plays a significant role in determining collateral value and a borrower’s ability to repay, influencing the overall risk profile of a title loan. By recognizing this relationship, borrowers can employ strategies to mitigate risks, ensuring more favorable loan terms and conditions. Lenders, too, can use this knowledge to make informed decisions, ultimately fostering a healthier lending environment.