In title loan risk assessments, collateral plays a pivotal role by offering lenders legal protection and influencing borrower eligibility. When borrowers pledge assets like vehicle registration documents (title pawns), lenders can repossess and sell the collateral upon default. Understanding collateral's value strengthens risk management, providing lenders with certainty and flexible repayment options for borrowers. This dynamic shifts the assessment to consider both borrower affordability and collateral worth, enabling a more nuanced evaluation. In San Antonio, where quick cash solutions are common, lenders assess asset quality and value to mitigate risks effectively, offering competitive loan terms while ensuring their security. Best practices in title loan risk assessment include detailed vehicle inspections using standardized tools and analyzing historical data through analytics platforms to predict long-term reliability. Staying informed about industry trends and regulatory changes is also crucial to align assessment methods with current market dynamics, including unique factors in niche areas like truck title loans.

In the intricate landscape of title loan risk judgments, collateral emerges as a pivotal factor shaping lender decisions. This article delves into the multifaceted role of collateral, exploring its profound impact on mitigating or intensifying loan default risks. We dissect the nuances of understanding collateral within the context of title loans and present best practices for rigorous assessment, empowering lenders to navigate this dynamic sector effectively. By mastering these strategies, lenders can enhance their risk assessment capabilities in title loan agreements.

- Understanding Collateral in Title Loan Risk Judgments

- The Impact of Collateral on Loan Default Risks

- Best Practices for Assessing Collateral in Title Loans

Understanding Collateral in Title Loan Risk Judgments

In the realm of title loan risk assessments, collateral plays a pivotal role, acting as a safeguard for lenders and a crucial factor in borrower eligibility. Collateral refers to the asset or property that borrowers offer as security against their loan. For instance, a title pawn involves using a vehicle’s registration documents as collateral. This approach ensures that if the borrower defaults on their payments, the lender has legal recourse to repossess and sell the secured asset.

Understanding collateral is essential in gauging risk. Secured loans, by nature, provide lenders with greater certainty due to the built-in protection. Repayment options become more flexible for borrowers as they can potentially retain possession of their collateral during the loan period. This dynamic shifts the risk equation, allowing for a more nuanced assessment based on both borrower affordability and the value of offered collateral.

The Impact of Collateral on Loan Default Risks

The value of collateral plays a pivotal role in mitigating risks associated with title loans, providing lenders with a safety net against potential loan defaults. When borrowers offer an asset as collateral, such as a vehicle, it acts as insurance for the lender, ensuring that if the borrower fails to repay, the lender can seize and sell the collateral to recover the outstanding loan amount. This practice significantly reduces the risk of loss for lenders, especially in cases of bad credit loans where traditional borrowing options are limited.

In San Antonio Loans, for instance, where borrowers often seek quick cash solutions, collateral becomes an essential component in the title loan risk assessment process. Lenders carefully evaluate the quality and value of the collateral to determine its potential as a recovery source if needed. This assessment is crucial in managing the overall risk profile of the loan, enabling lenders to offer competitive terms while ensuring financial security. Additionally, understanding the impact of collateral can facilitate discussions around loan extension options for borrowers who encounter temporary financial difficulties.

Best Practices for Assessing Collateral in Title Loans

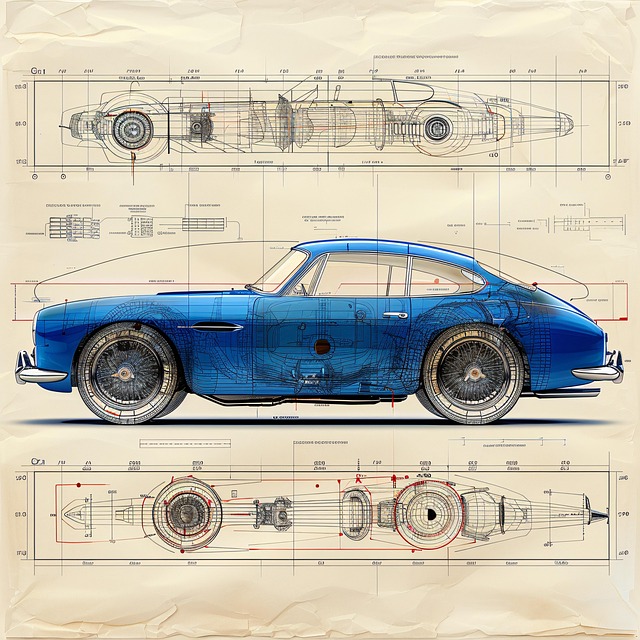

When assessing collateral for a title loan, adherence to best practices is paramount. This includes comprehensive vehicle inspection, where every aspect of the car’s condition—from engine performance to exterior and interior damage—is meticulously evaluated. Using standardized assessment tools ensures consistency in determining the true market value of the vehicle, which directly influences loan eligibility and risk assessment.

Moreover, a thorough review of the vehicle’s history through data analytics platforms provides valuable insights into potential maintenance issues or prior accidents. This secondary analysis, coupled with physical inspections, helps predict long-term reliability, thereby enhancing the accuracy of title loan risk judgments. Additionally, staying updated on industry trends and regulatory changes ensures that assessment methods are aligned with current market conditions, particularly in niche areas like truck title loans, where unique factors might impact collateral value.

Collateral plays a pivotal role in title loan risk judgments, significantly influencing loan default risks. By understanding its impact and implementing best practices for assessing collateral in title loans, lenders can enhance their risk assessment strategies. This comprehensive approach ensures safer lending decisions, fostering a more robust and reliable financial environment for both lenders and borrowers in the title loan sector. Effective collateral evaluation is key to mitigating risks and optimizing the overall success of title loan operations.