Houston and San Antonio lenders assess title loan risk by scrutinizing high-value assets like cars and motorcycles. This includes vehicle valuation, condition checks, and borrower creditworthiness through appraisals, reports, and financial reviews. Both parties share responsibility for mitigation using data analytics, transparency, proactive communication, and responsible lending practices to ensure secure agreements.

Title loans on high-value vehicles present unique challenges, demanding a meticulous risk assessment. This article delves into the intricacies of understanding and managing risks associated with such assets. We explore assessment methods, offering insights on evaluating vehicle title loans effectively. Furthermore, we provide strategies for lenders and borrowers to mitigate potential dangers, ensuring informed decision-making in this lucrative but risky sector. By leveraging proper risk assessment techniques, industry stakeholders can navigate these complexities successfully.

- Understanding Title Loan Risks for High-Value Assets

- Assessment Methods: Evaluating Vehicle Title Loans

- Mitigating Dangers: Strategies for Lenders and Borrowers

Understanding Title Loan Risks for High-Value Assets

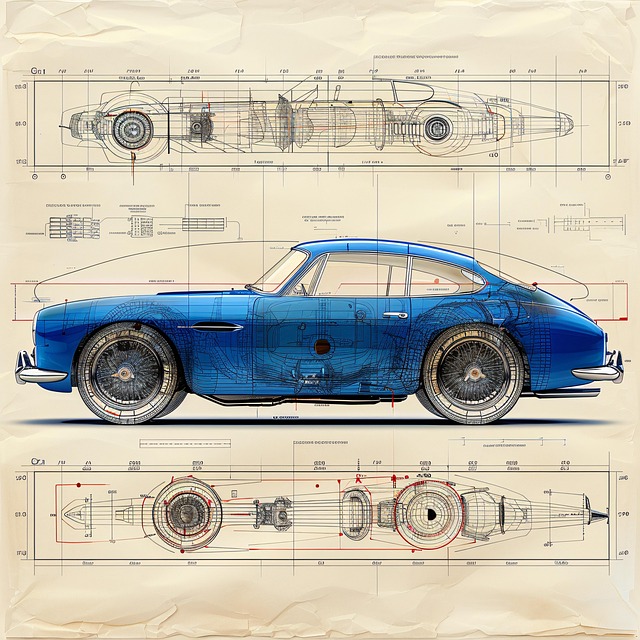

When considering a title loan risk assessment for high-value vehicles like cars or motorcycles (specifically in the context of Houston Title Loans), understanding the inherent risks is paramount. These loans, secured by the vehicle’s title, present unique challenges compared to traditional financing options. The primary concern lies in the potential devaluation of the asset, which can significantly impact the lender’s recovery position if the borrower defaults.

Vehicle valuation plays a crucial role in mitigating these risks. Accurate appraisal ensures lenders set appropriate loan-to-value ratios, minimizing exposure. For instance, in the competitive Houston market, where motorcycle title loans are prevalent, assessing the true market value of a bike is essential to balance risk and reward for both parties involved.

Assessment Methods: Evaluating Vehicle Title Loans

When it comes to assessing risk in title loan processes, especially for high-value vehicles, lenders must employ meticulous methods. The primary focus is on evaluating the collateral’s worth and the borrower’s ability to repay. This involves a comprehensive inspection of the vehicle’s condition, age, and market value, ensuring accuracy through professional appraisals or certified mechanics’ reports.

Additionally, a thorough review of the borrower’s financial history and current income is imperative. This includes examining employment records, credit scores, and outstanding debts. San Antonio loans and Houston title loans lenders should consider these factors to mitigate risk, as they provide insights into the borrower’s reliability and potential for default. Such an approach ensures responsible lending while offering feasible terms for both parties involved in the title loan process.

Mitigating Dangers: Strategies for Lenders and Borrowers

Mitigating dangers is a key aspect of any financial transaction, especially when it comes to title loans for high-value vehicles. Lenders and borrowers alike must employ strategies to ensure a secure and mutually beneficial agreement. For lenders, a comprehensive title loan risk assessment is non-negotiable. This involves thoroughly verifying the vehicle’s ownership, its condition, and the borrower’s financial health. By implementing robust underwriting standards and utilizing advanced data analytics, lenders can minimize the risk of default and associated losses. Regular updates on market trends and regulatory changes are also vital to adapt assessment methods accordingly.

Borrowers, on the other hand, should prioritize transparency and honesty throughout the process. Disclosing any potential financial constraints or prior loan history is crucial, as it allows for tailored solutions. Additionally, understanding the implications of interest rates and repayment terms is essential. While same-day funding might be attractive, borrowers must consider the overall cost, including fees and charges, to ensure they can manage repayments without defaulting. Proactive communication with lenders can help establish a supportive relationship, fostering a collaborative environment to navigate any challenges that may arise during the loan period.

Title loan risk assessment is crucial for high-value vehicles, as it safeguards both lenders and borrowers. By understanding the risks involved, employing robust assessment methods, and implementing effective mitigation strategies, stakeholders can navigate this financial landscape with confidence. Evaluating vehicle title loans through comprehensive analyses ensures a fair and secure lending process, fostering a healthy market for high-end assets.